In India, vehicle insurance is not just a financial safeguard but a legal requirement under the Motor Vehicles Act, 1988. Ensuring your vehicle has valid insurance protects you from penalties, covers third-party liabilities, and secures you against own-damage costs.

Checking your vehicle’s insurance status regularly helps avoid lapses, ensures timely renewals, and aids in accident-related claims.

This guide details both online and offline methods to verify your vehicle’s insurance status efficiently.

Online Methods to Check Vehicle Insurance Status

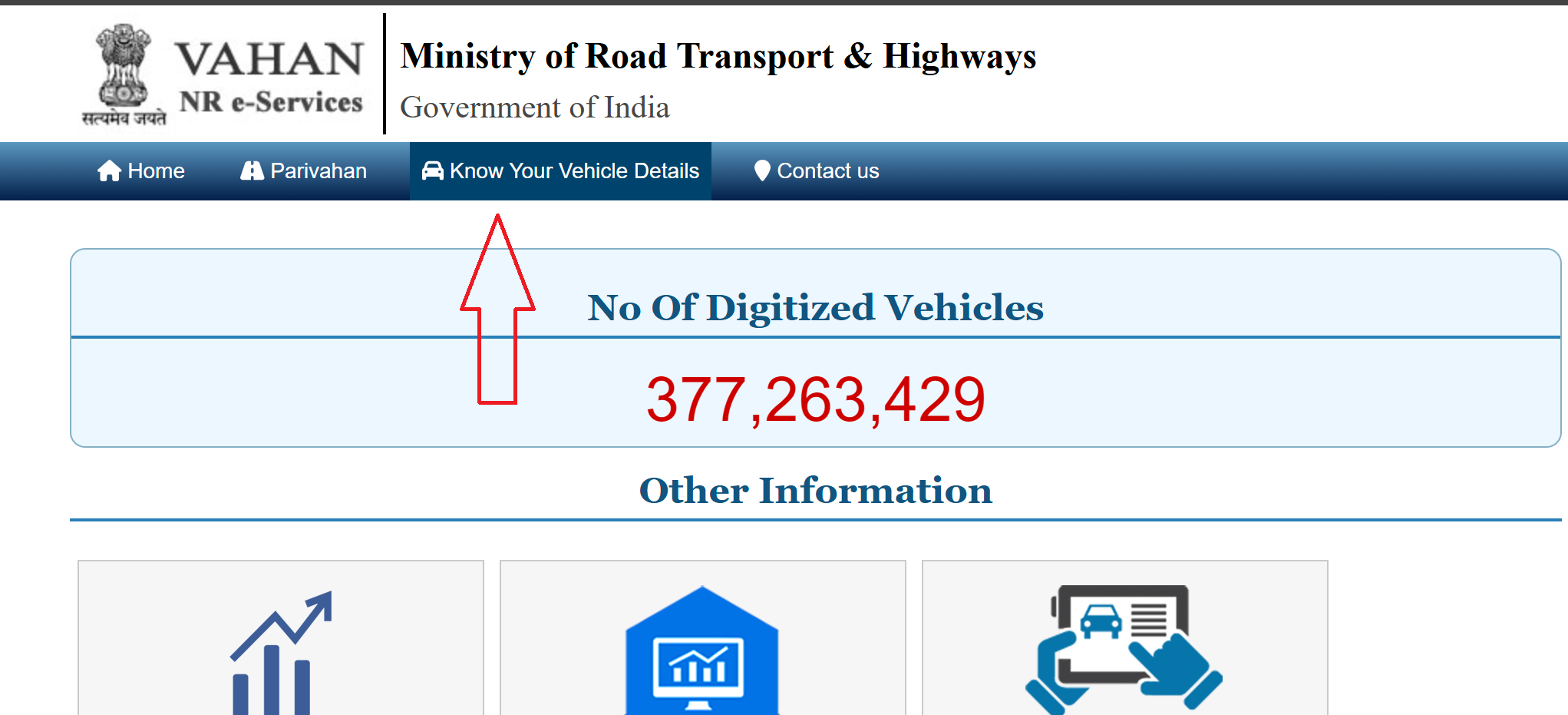

V A H A N | National Register e-Services

A centralized platform by the Ministry of Road Transport & Highways storing vehicle data. Steps:

- Visit official portal - https://vahan.parivahan.gov.in/nrservices/.

- Navigate to “Know Your Vehicle Details.”

- Log in or register using your mobile number.

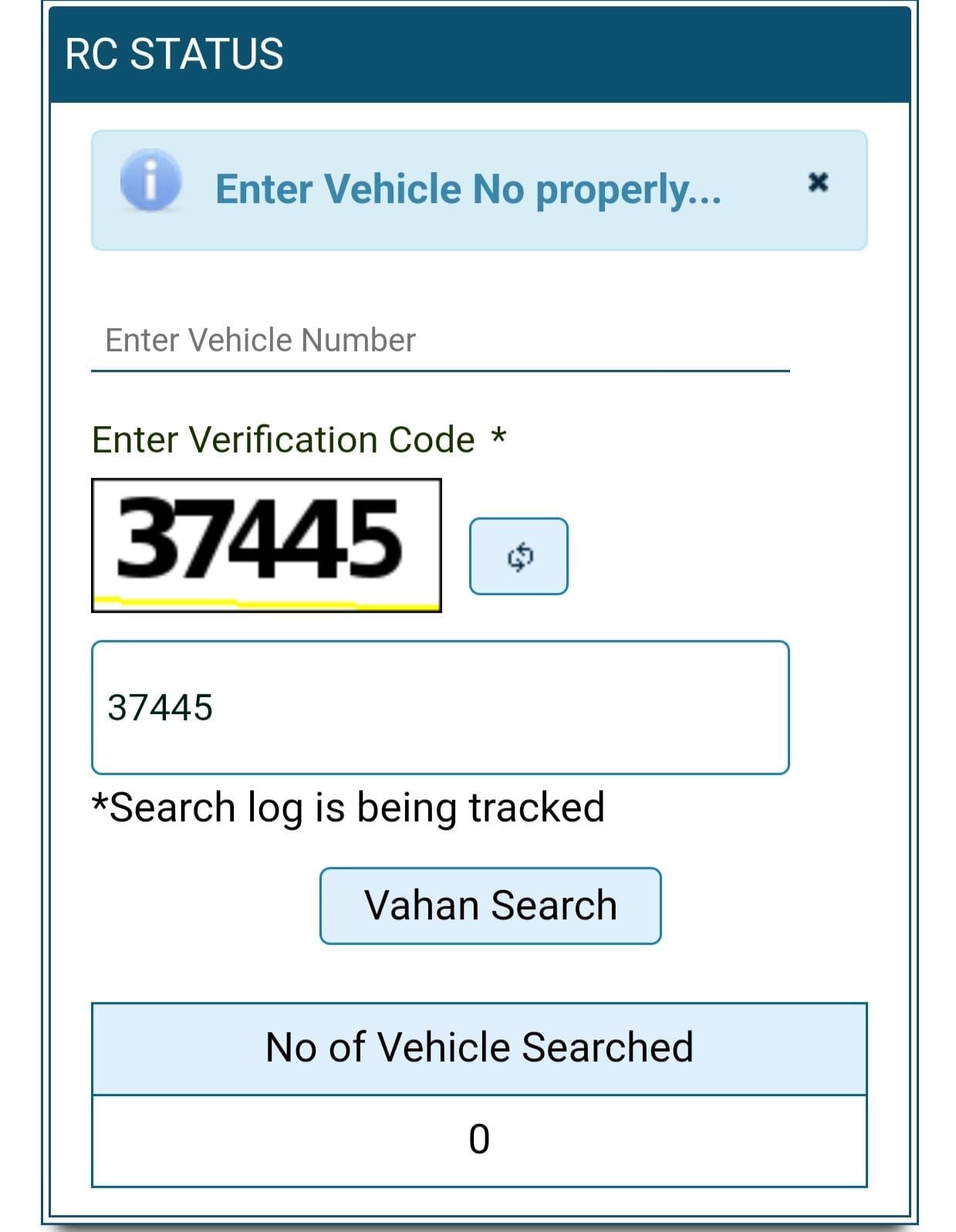

- Enter the vehicle’s registration number and verify with the CAPTCHA.

- View insurance details, including policy number, insurer, and expiry date.

2. Insurer’s Website or App

Most insurance providers offer online portals or mobile apps for policy management. Steps:

- Visit your insurer’s official website (e.g., HDFC Ergo, ICICI Lombard) or download their app.

- Log in with policyholder credentials or register using policy number.

- Enter vehicle registration or policy number.

- Check policy status, expiry date, and coverage details.

Popular Insurers:

- Bajaj Allianz: bajajallianz.com

- Reliance General: reliancegeneral.co.in

- Tata AIG: tataaig.com

Offline Methods to Check Vehicle Insurance Status

1. Visit the Regional Transport Office (RTO)

RTOs maintain vehicle records, including insurance details. Steps:

- Locate your nearest RTO office.

- Provide vehicle registration number and chassis/engine number.

- Request insurance status from the RTO official.

Documents Needed:

- Vehicle registration certificate (RC)

- Identity proof

- Insurance policy copy (if available)

2. Contact Insurance Provider

Directly reach out to your insurer for detailed information. Steps:

- Call the insurer’s customer care (e.g., toll-free numbers listed on their website).

- Provide policy number or vehicle registration details.

- Request policy status and validity.

3. Visit an Insurance Agent or Broker

If purchased through an agent, they can assist with status checks. Steps:

- Contact your agent with vehicle and policy details.

- Request them to verify insurance status via their portal.

Tips for Accurate Insurance Status Checks

- Keep Documents Ready: Vehicle registration number, chassis/engine number, and policy number are essential.

- Verify Data Entry: Double-check registration number format (e.g., DL05AB1234).

- Check Expiry Dates: Renew policies before expiry to avoid penalties.

- Cross-Verify: Use multiple methods (e.g., Parivahan and insurer’s portal) for accuracy.

- Beware of Fraud: Use only official websites and verified contact numbers.

Penalties for Driving Without Valid Insurance

In India, driving without valid insurance is illegal under the Motor Vehicles Act, 2019. Penalties include:

- First offence: ₹2,000 fine and/or up to 3 months imprisonment.

- Second offense: ₹4,000 fine and/or up to 3 months imprisonment.

Additional consequences:

- Vehicle seizure until valid insurance is shown.

- Personal liability for accident damages.

- Possible suspension of driving license or vehicle registration.

Applies to all vehicles (two-wheelers, four-wheelers, commercial).

Additional Tips

- Renew Early: Renew insurance 15–30 days before expiry to avoid lapses.

- Verify Third-Party Insurance: Mandatory for all vehicles; check via IIB or Parivahan.

- e-Vahan Bima: Use apps like mParivahan to store digital insurance copies.

- Fraud Prevention: Cross-check insurer details to avoid fake policies.

Difference Between First-Party and Third-Party Vehicle Insurance

Vehicle insurance in India ensures legal compliance and financial security. Third-party insurance, mandatory under the Motor Vehicles Act, 1988, covers damages to others, while optional first-party insurance protects the policyholder’s vehicle.

| Feature | First-Party Insurance | Third-Party Insurance |

|---|---|---|

| Coverage | Policyholder and their vehicle | Third parties (others’ property/people) |

| Scope | Own-damage (accidents, theft, fire, natural disasters) | Damages/injuries caused by your vehicle |

| Legal Requirement | Optional | Mandatory (Motor Vehicles Act, 1988) |

| Exclusions | Third-party damages | Policyholder’s vehicle damage |

| Example | Repairs for your car after a crash | Compensation for hitting another car |

Types of Vehicle Insurance Policies

- Comprehensive Insurance: Combines first-party and third-party coverage. Protects against own-damage (accidents, theft, natural calamities) and third-party liabilities. Includes add-ons like zero depreciation, roadside assistance.

- Standalone Own-Damage (OD) Insurance: Covers only the policyholder’s vehicle. Requires separate third-party policy to meet legal requirements.

- Pay-As-You-Drive Insurance: Premium based on kilometers driven. Ideal for low-usage vehicles.

- Bundled Policies: Combine third-party and own-damage for new vehicles (up to 3 years for two-wheelers, 1 year for four-wheelers).

Add-On Covers

Enhance comprehensive policies for extra protection:

- Zero Depreciation: Full claim without factoring in depreciation of parts.

- Roadside Assistance: Covers towing, fuel delivery, tire changes.

- No-Claim Bonus (NCB) Protection: Retains NCB discount despite claims.

- Engine Protection: Covers engine damage from water ingress or oil leaks.

- Personal Accident Cover: Compensation for death or disability of the policyholder.

Factors Affecting Premiums

- Vehicle Type: Higher for luxury or high-capacity vehicles.

- Age of Vehicle: Older vehicles may have higher premiums due to repair costs.

- Geographical Location: Urban areas with higher accident rates increase premiums.

- Driver’s Profile: Age, driving history, and claims affect rates.

- Add-Ons: Additional covers increase premium costs.

Claim Process

- Inform Insurer: Notify immediately after an incident.

- File FIR: For accidents, theft, or third-party claims.

- Submit Documents: Policy copy, RC, DL, FIR, repair bills.

- Survey: Insurer assesses damage for approval.

- Settlement: Cashless (network garage) or reimbursement.

Common Exclusions

- Wear and Tear: Normal ageing or mechanical failure not covered.

- Drunk-Driving: Claims denied if driver is intoxicated.

- Unlicensed Driver: No coverage if driver lacks a valid license.

- Non-Approved Modifications: After market changes may void claims.